This morning we got the non-farm payroll report for the month of July. Economists were expecting to only add 250,000 jobs. Instead we came in with a huge beat, adding 528,000 jobs into the economy. Average hourly earnings m/m also beat expectations, coming in at 0.5% vs. 0.3% expected. On a year-over-year basis, labor costs are up 5.2% for businesses in the past year. The unemployment rate ticked down for the first time in 4 months, with unemployment being officially at 3.5%.

I will be the first to admit this NFP report surprised me, and I think it surprised the markets as well. The big beat projects more economic strength than may have been anticipated, which means that inflation is going to continue picking up. For now, the stagflation argument has been taken down a few pegs since growth seems to be continuing here. Of course, this means the Fed has a lot more work to do on fighting inflation, which I will cover momentarily. First, let’s break down the data that came in this morning.

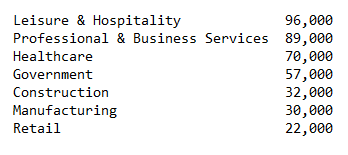

For the non-farm payrolls, here is where the jobs were added for July:

Unlike the jobs report for June, July added most of its jobs in the lower-paying sectors, and government payrolls contributed a decent portion to the overall jobs total. What is most notable to me is the decline in retail jobs added, as well as the low amount of manufacturing and construction jobs. Construction jobs should be increasing during the summer months when the weather prohibits more building than the winter season. Instead, the sector remains extremely weak. This is why the ITB 0.00%↑ traded down 2% directly after the release of the payrolls.

Another reason that the ITB 0.00%↑ traded down initially was for the same reason the XLF 0.00%↑ rallied right at the start of the tape. If economic data is continuing to come in stronger than expectations, the Fed has to be expected to continue on its rate hiking cycle to kill inflation. Higher interest rates coupled with economic growth is very bullish for banks. What traders don’t seem to understand however, is that the economy is not growing and the numbers from the jobs report are actually weak beneath the surface.

While the unemployment rate ticked slightly lower, labor force participation rate fell slightly to 62.1%. What this indicates is that the unemployment rate did not fall from 3.6% to 3.5% because more Americans gained their first job since being unemployed. Instead, it is much more likely that some people who have been filing for unemployment have now reached 1 year of being unemployed, and are now considered discouraged workers who remain unemployed but are not captured in the official unemployment rate. Making matters worse, the amount of people holding part-time jobs is increasing, which is not a sign of a red-hot economy. Many people taking secondary part-time jobs shows the consumer is being stretched too much and inflation is causing their household budgets to become too high to sustain.

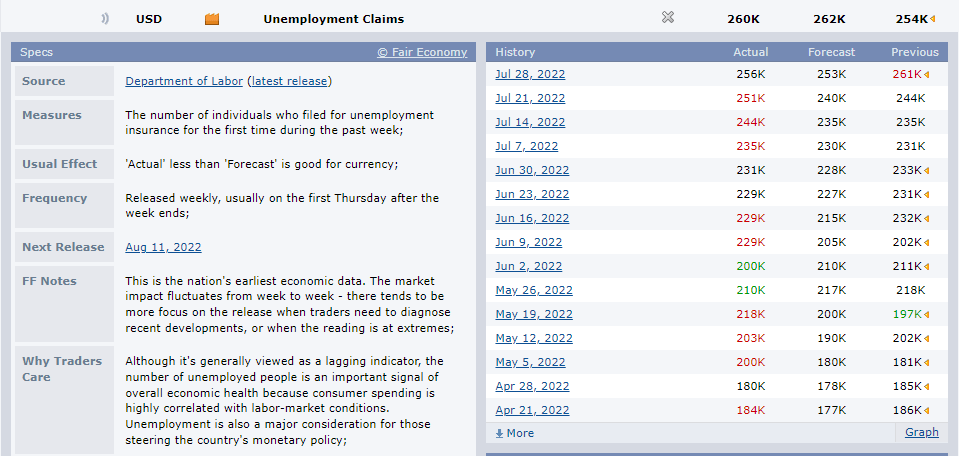

In fact, we got the weekly initial unemployment claims number yesterday

For the 7th straight week initial unemployment claims increased, yet the unemployment rate decreased by 0.1%? Again, this simply shows that when you look beneath the surface, we have more and more unemployed folks joining the ranks of the discouraged worker.

Of course, since everyone is operating on the headline numbers, the markets now have to start pricing in more rate hikes from the Fed. One of the reasons I believe the markets recovered some losses intra-day Friday is because investors are now convinced that the Fed rate hikes are not going to push the economy into a deep recession. Investors think more rate hikes are going to be enough to break the back of inflation, but not the back of the economy. I still believe they are wrong on both fronts.

Firstly, now that the economy is in an official unofficial recession, I have been proven right on something I have been saying since the start of the year - a recession alone will not cause inflation to moderate or decline. Think about it this way; we have had a contracting economy for six months now. During each of those six months, inflation continued to accelerate higher in every single metric used to capture higher prices. This would include the Consumer Price Index, Producer Price Index, Personal Consumption Expenditures Index, Inflation Expectations, and Average Hourly Earnings. This should be a flashing indicator to investors that inflation is embedded in the economy and never going away, yet the traders in the foreign exchange and bond markets remain absolutely clueless.

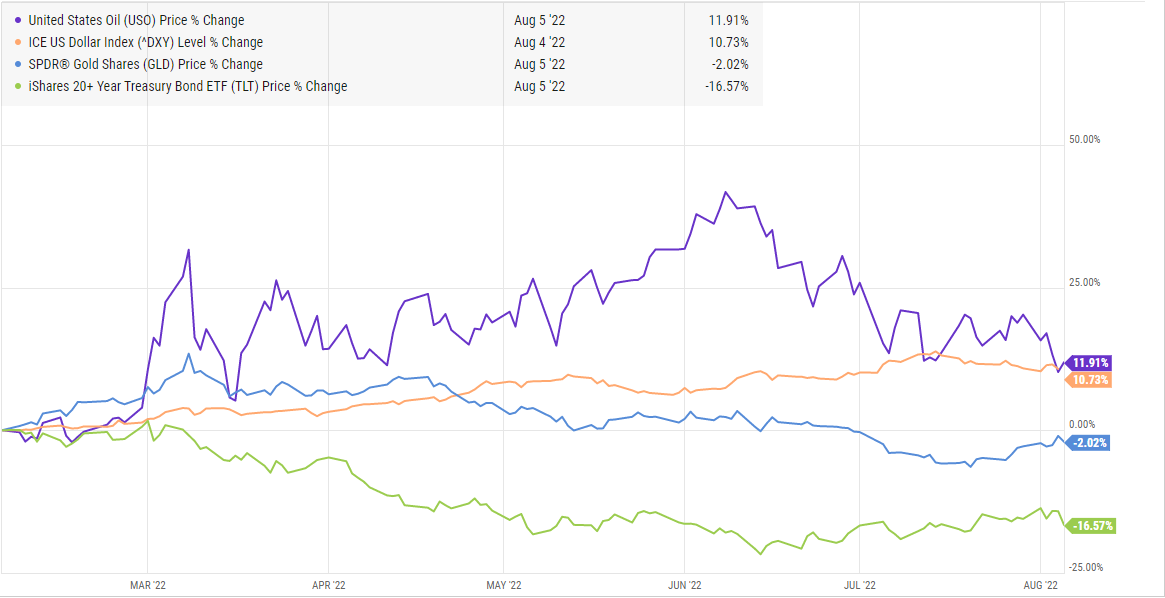

Upon release of today’s NFP report, the US Dollar Index immediately rallied back near the $106 level. This caused an immediate sell-off in gold, which is holding up relatively well at $1775 as I’m writing this. Oil rallied back off the lows on the idea that the economy remains strong. This week oil saw rather sharp declines on recession fears, trading as low as $87 per barrel.

In fact, looking at a 6-month chart, the US Oil Fund is close to reaching its lowest level since the start of the year. This is emboldening the ‘peak inflation’ crowd, who are all jumping at any reason to get positive on the economy. I don’t see what all the excitement is about personally. Oil prices have been very resilient and have recovered losses from every sell-off of late. With strong economic data (on the surface only) oil is probably going to trade higher from here in the short-run. Due to the continuation of supply constraints in the oil industry, oil is almost certainly going to continue to trade higher on a longer-term basis anyway.

Another aspect of the above chart is the performance of gold in the face of a face-ripping 6-month dollar rally. For the $DXY to go on a 10% run in a 6-month period is very significant. The fact that this only caused a 2% decline in the GLD 0.00%↑ shows that there is some underlying strength in the yellow metal. It also seems gold is trying to find a bottom this week. We have already rallied back $100 off the lows in a very short period of time, and the gold market is looking to break-through $1795 resistance. As far as the gold mining stocks are concerned, they are now benefiting from gold tailwinds, along with a drop in Crude Oil prices.

Lastly, despite the TLT 0.00%↑ being down 16% on the year, bond traders are still dramatically overpricing the value of long-term government bonds. Bond traders just don’t get it. Their refusal to price-in longer-term inflation expectations shows they have their heads buried in the sand. It is amazing that I can say that with bonds having one of their worst starts to a year in the history of the United States, they remain in bubble territory. Especially if you consider the rise in the US dollar Index this year. Long-term government bonds are promise notes to pay dollars in the future, and those dollars have been getting more valuable in the foreign exchange markets, yet bonds still can’t rally. That is why I think we are topping out in bonds here. I think some traders have been buying them on recession fears. Now that those fears are going to get suppressed in the upcoming weeks, the trade should be to sell bonds.

Of course, I can’t bring up bonds with mentioning the biggest owner of US Treasuries, the Federal Reserve.

The balance sheet did see a slight pickup in reduction this week. If the Fed really starts to become a bigger seller, there is no reason to hold an asset when the world’s biggest owner is about to start selling. To me, selling bonds is really a no-brainer here.

Wrapping up on a different note, DASH 0.00%↑ reported earnings yesterday after the close. The stock popped 18% in the after-hours on notes that revenues beat expectations and that total orders have increased by 23% year-over-year. Despite both of these positives, the stock managed to miss its earnings expectations by a large margin, posting EPS of -$0.72 vs. the -$0.41 expected. Now I have to tell you. When a company reports a wide beat on its revenue forecast but has a major miss on its bottom-line profits, that is a very bad look moving forward.

This shows me that DASH 0.00%↑ is underperforming from a business management standpoint when times are good for their business. I did not have a chance to take a deeper dive into their quarterly report, but I would have to imagine most of their order increases from the past fiscal year occurred in the first half of the year, when the economy was much stronger. With the consumer continuing to run out of disposable income for discretionary spending due to inflation, DASH 0.00%↑ is going to have more difficult times ahead.

(*Side note: credit-card debt is now skyrocketing to new highs, with credit card spending hitting its highest levels in 20 years. The savings-rate for households is at its lowest levels since the depths of the 2008 Financial Crisis, despite the economy having a 3.5% unemployment rate).

Their inability to control customer acquisition costs and the fact they are suffering from high labor costs, despite the recent pullback in gas prices for delivery drivers, tells me that the stock and the business has seen its best days. The CEO even mentioned on the earnings call that he expects much softer consumer spending in the future months.

They are also not reporting a significant amount of the salary expenses, since a lot of that is being paid to employees in the form of share-based compensation. Meaning, their ‘adjusted’ earnings are not anywhere as good as their actual earnings. Despite this, they still trade at approximately 5x sales, which makes them 4x as expensive as UBER 0.00%↑ & LYFT 0.00%↑ , which both have better businesses because of their focus on ride-sharing as opposed to food delivery.

I would imagine a lot of people took on part-time jobs with DASH 0.00%↑ as part-time employment continues to bolster the labor statistics. This was something that helped DASH 0.00%↑ grow revenues. Still having never even coming close to turning a profit, this company continues to act as a cash incinerator, despite growing its workforce and trying to expand operations. A food delivery business is simply not scalable, because delivery people can only make so many delivery per hour. There is no way for productivity in their workforce to be increased, and they lose money on every delivery. They are going to remain structurally unprofitable.

I’m staying short, and I think I will get this right by next quarter.

Have a great weekend, next edit out Monday morning before market open!

Best,

Ryan Garzone

True North Market Research

truenorthinternationalpartners@gmail.com